Fourteenth Amendment and The Debt Ceiling: A Strategy to Avoid Default and Not Succumb to Economic Terrorism

Treasury Should Continue to Borrow, and the Biden Administration Should Seek a Declaratory Judgment and Injunction Before the Supreme Court

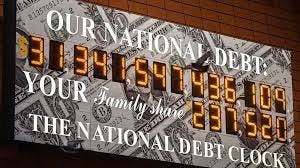

Everyone is once again up in arms about the Debt Ceiling. Treasury Secretary Yellen predicts that the U.S. will hit the current statutory debt ceiling in June or July, 2023. The Biden Administration says, with good foundation, that if the U.S. hits the debt ceiling when new principal and interest obligations on existing U.S. debt put us over the top of the current statutory debt ceiling, economic chaos will ensue not only in the U.S. but around the world as the U.S. will not have available funds to pay current obligations authorized and approved by Congress in the past. The U.S. dollar is still the Reserve currency, and all other nations rely on it. If the U.S. defaults on its obligations, an economic catastrophe is looming as credit markets will freeze up, businesses will not be able to borrow, government payroll payments will stop, and the U.S. will be seen as an unreliable economic partner by other nations.

The Republicans in Congress see this is an opportunity to once again hold the nation economically hostage by demanding severe cuts in many governmental programs as a precondition to their agreement to increase the debt ceiling. Speaker McCarthy got his economic hostage package to pass the House this week, losing only four Republican votes, after kowtowing to additional demands of the far right-wing misnamed Freedom Caucus, led by Rep. Gaetz and others. As reported by CNN:

“This is what gets us in the game,” said Rep. Kelly Armstrong of North Dakota. “This is the first conversation. The next conversation is what comes next and we know that and this is part of negotiation. We know we don’t control all three. We don’t control the White House and the Senate but this gets us where we need to start.”

And McCarthy’s bill would only increase the debt ceiling for eleven months so we would be back in the same position next March during the presidential nomination contest. Democrats quickly declared the McCarthy debt ceiling bill Dead on Arrival.

This stalemate is a repeat of the economic hostage taking practiced by the Republicans during Obama’s Administration, but he finally acquiesced in a compromise package that still imposed severe cuts and economic constraints that Democrats say they will not repeat again. See 31 U.S.C. sec. 3101A.

What is the debt ceiling? It is a creation of Congress which after passing appropriation bills then imposes additional constraints on spending so that appropriated items would cause an increase in total U.S. debt when the U.S. does not have available cash to pay all its obligations above the statutory debt ceiling. So, Congress appropriates, but then if it refuses to raise the debt ceiling so all the programs for which appropriations were adopted cannot be funded.

The debt ceiling is found in 31 U.S.C. sec. 3101(b), and in its current version it states:

(b) The face amount of obligations issued under this chapter and the face amount of obligations whose principal and interest are guaranteed by the United States Government (except guaranteed obligations held by the Secretary of the Treasury) may not be more than $14,294,000,000,000, outstanding at one time, subject to changes periodically made in that amount as provided by law through the congressional budget process described in Rule XLIX of the Rules of the House of Representatives or as provided by section 3101A or otherwise.

At present once total principal debt guaranteed by the U.S. exceeds $14,294,000,000,000, the debt ceiling is exceeded, and Treasury cannot borrow more to pay its bills for all the programs that Congress has already passed. It is the proverbial second bite of the apple for those willing to sabotage and not fund what they already agreed to fund. So, why did Congress give itself this second bite of the budget apple? And why didn’t the last Congress extend or abolish the debt ceiling in 2022 when they had the votes? Many political questions and interests in those two questions.

But in all the debates on the debt ceiling, most omit reference to the fact that Congress has given the President borrowing authority through the Secretary of the Treasury. There are five sections granting that authority. The first is 31 U.S.C. sec. 3102(a) which allows issuance of Bonds:

(a) With the approval of the President, the Secretary of the Treasury may borrow on the credit of the United States Government amounts necessary for expenditures authorized by law and may issue bonds of the Government for the amounts borrowed and may buy, redeem, and make refunds under section 3111 of this title.

Then 31 U.S.C. sec. 3103(a) allows issuance of Notes:

(a) With the approval of the President, the Secretary of the Treasury may borrow on the credit of the United States Government amounts necessary for expenditures authorized by law and may issue notes of the Government for the amounts borrowed and may buy, redeem, and make refunds under section 3111 of this title.

Then 31 U.S.C. sec. 3104(a) allows issuance of Certificates of Indebtedness and Treasury Bills:

(a) The Secretary of the Treasury may borrow on the credit of the United States Government amounts necessary for expenditures authorized by law and may buy, redeem, and make refunds under section 3111 of this title. For amounts borrowed, the Secretary may issue-

(1) certificates of indebtedness of the Government; and

(2) Treasury bills of the Government.

Then 31 U.S.C. sec. 3105(a) allows issuance of savings bonds and savings certificates:

(a) With the approval of the President, the Secretary of the Treasury may issue savings bonds and savings certificates of the United States Government and may buy, redeem, and make refunds under section 3111 of this title. Proceeds from the bonds and certificates shall be used for expenditures authorized by law.

Finally, 31 U.S.C. sec. 3106(a) allows issuance of retirement and savings bonds:

(a) With the approval of the President, the Secretary of the Treasury may issue retirement and savings bonds of the United States Government and may buy, redeem, and make refunds under section 3111 of this title. The proceeds from the bonds shall be used for expenditures authorized by law.

Each of these sections says that the proceeds of the debt obligations “shall be used for expenditures authorized by law.” These sections authorize the President to approve issuance by the Secretary of the Treasury of various forms of debt obligations guaranteed by the United States to fund expenditures for programs and activities authorized by law.

Professors Buchanan and Dorf have written several articles dealing with the debt ceiling and argue that Sections 3102(a) through 3106(a) give the President authority to borrow for approved Congressional expenditures, and those sections are severable from the debt ceiling limitation of Section 3101(b). 113 Columbia Law Review 32 (2013). They cite a number of cases on severability to support their position.

Enter the Fourteenth Amendment, Section 4, adopted in 1868 after the Civil War, which states:

The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.

This provision was included as the Framers of the Fourteenth Amendment were concerned that representatives of Confederate states might later question the debt incurred to pay for the Civil War or Union veterans’ benefits. But applying it to the current situation, we have debt issued by the Treasury to pay Congressionally authorized expenditures, where such debt has been approved by the President under 31 U.S.C. Secs. 3102 to 3106. Since the President has the authority to issue debt for purposes authorized by law, does the Fourteenth Amendment, Section 4 say that public debt cannot be questioned?

And if the public debt issued for Congressionally authorized purposes cannot be questioned, does the debt limit of 31 U.S.C. sec. 3101(b) amount to an unconstitutional questioning of the authorized public debt?

The Supreme Court interpreted the meaning of Section 4 of the Fourteenth Amendment in Perry v. United States, 294 U.S. 330 (1935), where Perry was challenging a Joint Resolution of Congress which changed the terms for repayment of certain bonds from payment in gold to payment in dollars, and Perry claimed that would devalue the bonds he purchased. The Court noted that the bonds were authorized at the start of U.S. entry into World War I and known as Liberty Bonds:

The Act of September 24, 1917, both in its original and amended form, authorized the moneys to be borrowed, and the bonds to be issued, "on the credit of the United States" in order to meet expenditures needed "for the national security and defense and other public purposes authorized by law." 40 Stat. 288, 503. The circular of the Treasury Department of September 28, 1918, to which the bond refers "for a statement of the further rights of the holders of bonds of said series," also provided that the principal and interest "are payable in United States gold coin of the present standard of value." 294 U.S. at 348.

The authorizing statute and the Treasury circular provided that the bonds would be redeemed in gold coin. But in 1933, Congress adopted a Joint Resolution providing that the Liberty Bonds and others would be redeemed in dollars and not in gold:

The question is necessarily presented whether the Joint Resolution of June 5, 1933 (48 Stat. 113) is a valid enactment so far as it applies to the obligations of the United States. The Resolution declared that provisions requiring "payment in gold or a particular kind of coin or currency" were "against public policy," and provided that "every obligation, heretofore or hereafter incurred, whether or not any such provision is contained therein," shall be discharged "upon payment, dollar for dollar, in any coin or currency which at the time of payment is legal tender for public and private debts." This enactment was expressly extended to obligations of the United States, and provisions for payment in gold, "contained in any law authorizing obligations to be issued by or under authority of the United States," were repealed. 294 U.S. 350.

The Court reviewed the history of the Fourteenth Amendment, section 4 and rejected the argument of some that it only applied to Civil War debts, and it concluded that the Joint Resolution of 1933, changing the terms for repayment to payment in dollars and not gold coins, was unconstitutional essentially as an impairment of contracts and government obligations:

The Fourteenth Amendment, in its fourth section, explicitly declares: "The validity of the public debt of the United States, authorized by law, . . . shall not be questioned." While this provision was undoubtedly inspired by the desire to put beyond question the obligations of the Government issued during the Civil War, its language indicates a broader connotation. We regard it as confirmatory of a fundamental principle, which applies as well to the government bonds in question, and to others duly authorized by the Congress, as to those issued before the Amendment was adopted. Nor can we perceive any reason for not considering the expression "the validity of the public debt" as embracing whatever concerns the integrity of the public obligations. We conclude that the Joint Resolution of June 5, 1933, in so far as it attempted to override the obligation created by the bond in suit, went beyond the congressional power. 294 U.S. at 354.

That is well and good for obligations created before Congressional action to impair the obligation, but does that answer the question whether the President has authority to direct the Treasury to issue new debt that would cause the total public debt to exceed the debt limit of 31 U.S.C. sec. 3101(b)? But what if the Treasury is merely issuing new debt to repay old debt at better interest rates as with the case now with increases in the Federal Reserve Federal Funds Rate? Of course, that would not increase principal outstanding but would increase interest owing.

Now let’s suppose that the President decides that he cannot negotiate with the House Speaker on the debt ceiling because the Speaker’s terms are too harsh, and his Freedom Caucus will keep him in line if he deviates from their goals and where they reserved the right for only one member to move to remove the Speaker. So, if the Speaker acquiesces to the President on budget and debt issues, the Freedom Caucus may move to remove the Speaker. That suggests the Speaker may not be too bold in negotiating with and acquiescing to the President or he will potentially lose his Speakership.

So, how do we get out of this conundrum? I suggest that the best alternative is for the Biden Administration to adopt an aggressive interpretation of the President’s powers under 31 U.S.C. sec. 3102 through 3016 and agree with Professors Buchanan and Dorf that the President’s authority to incur debt is severable from the public debt limit of Section 3101(b). The President has authority to incur debt for purposes already authorized by law in Congressional enactments and that authority is severable from the debt limit.

Since the debt limit of Section 3101(b) has the effect of preventing the President from incurring debt for legislatively approved purposes which the President has authority to do, the debt limit should be severable from the President’s authority. If the President decides to go forward and direct the Treasury to incur debt in excess of the debt limit, who can challenge that directive?

The case of Williams v. Lew, 819 F.3d 466 (D.C. Cir. 2016), suggests that most private parties would not have standing to challenge the President’s actions.

I would suggest the following strategy: the President directs the Attorney General to file an original action in the Supreme Court under 28 U.S.C. sec. 1251(b)(2) as an action by the United States against a State that objects to debt exceeding the debt limit of Section 3101(b). There are probably several States that would be willing to be Respondents in the Supreme Court.

Now assuming that the Treasury has gone ahead and issued new obligations after the debt ceiling were exceeded, it is highly unlikely that the Supreme Court would be willing to step in and invalidate debt issued by the United States as their decision would truly cause economic calamity in the credit markets and by and by and among foreign nations. But a better strategy would be for the United States to file the Petition or Complaint in the Supreme Court before the debt ceiling is exceeded where the U.S. would seek a declaratory judgment that the debt limit is unconstitutional on its face or that as applied it interferes with the President’s authority to issue debt to fund Congressionally approved programs and activities and an injunction against the State(s) from questioning the U.S. debt.

In either case the Court will be reluctant to intervene. It might invoke the political question doctrine. Or it may hold the issue is non-justiciable. It may look for some out from the conundrum it now faces. It is also possible that following the course of choosing the most acceptable argument to keep the nation afloat financially it would decide that the debt limit does violate the Fourteenth Amendment. Or it might decide the provisions of 31 U.S.C. sections 3102 through 3106 are severable from 3101(b).

No matter how the Court disposes of the case, its decision will probably confirm that the new debt issued by Treasury is valid debt of the United States or it would duck the issue. It is extraordinarily doubtful that the Court would declare the new debt to be unlawful and void. The consequences to the U.S. and the world economy would be too great. So, the unlikelihood of a negative decision from the Court should suggest to the Biden Administration that this route is the best way to proceed and far better than trying to negotiate an unacceptable deal with Speaker McCarthy and the Freedom Caucus. President Biden knows how President Obama was tied in knots trying to compromise in 2011 resulting in 31 U.S.C. sec. 3101A, a truly horrific budget provision, and a compromise the Obama Administration came to regret.

So, all the Biden Administration needs to do is find an unfriendly State(s) and let the Supreme Court figure out how not to wreck the United States and world economy. It may keep the Court from committing judicial mayhem in other areas.