The Judicial Conference Should Report Justice Thomas to the Attorney General for Prosecution

5 U.S.C. Appendix 104 says the Judicial Conference Shall Report to the AG Anyone Failing to Make Truthful Disclosures in Required Ethic Filings

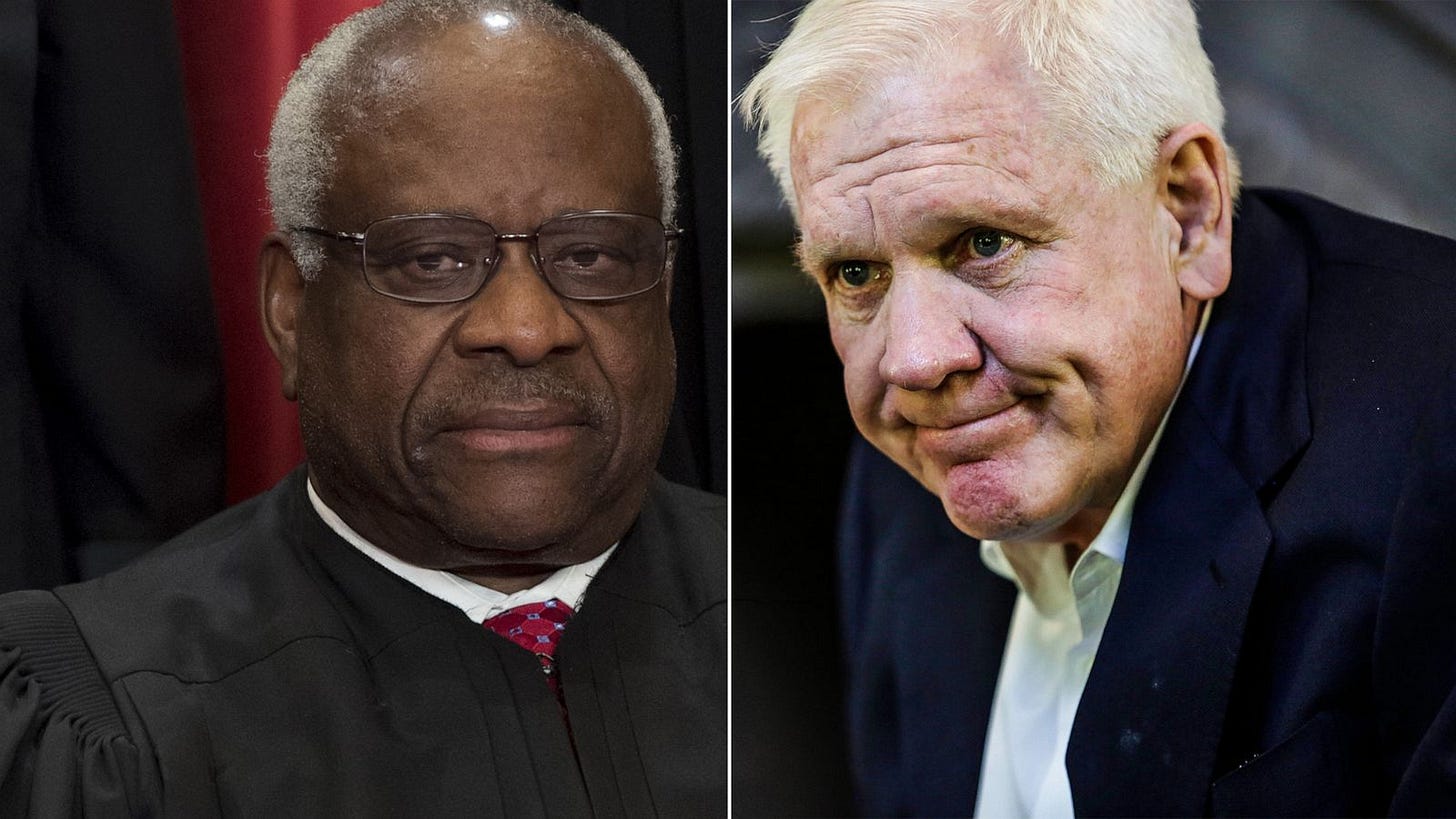

It has now been reported that in addition to the twenty years of receiving very expensive gifts in the form of luxury travel, lodging and transportation from billionaire Harlan Crow without disclosing same in required financial and ethics filings, Justice Thomas also personally benefitted financially from a previously undisclosed real estate transaction with Harlan Crow. ProPublica has reported that Harlan Crow paid about $130,000 to buy a house that was jointly owned by Justice Thomas and his mother, and then Crow for substantial renovations to the home and bought an adjoining property and tore down the neighboring house increasing Mother Thomas’ open space. The proceeds of the sale of Mother Thomas’ house generated income for Justice Thomas in excess of the $1,000 minimum for real estate sale proceeds that must be reported by Federal Employees like Justice Thomas who reportedly earns $285,000 per year as a sitting Supreme Court Justice.

But as with the other Crow paid lodging, transportation and food, Justice Thomas did not report the Crow-Thomas real estate transaction from which he personally benefitted. Justice Thomas’ mother reportedly still lives in the house under some form of lease arrangement with Crow, and perhaps without paying rent.

So now we have a twenty-year history of Crow bestowing largesse on Thomas which was not reported by Thomas, and now we have a real estate transaction generating in excess of $1,000 to Justice Thomas from the purchase of Thomas Mother’s house by Crow but which Justice Thomas did not report in his financial disclosure forms.

Justice Thomas has a major problem. 5 U.S.C. Appendix 104 provides the following:

(a) (1) The Attorney General may bring a civil action in any appropriate United States district court against any individual who knowingly and willfully falsifies or who knowingly and willfully fails to file or report any information that such individual is required to report pursuant to section 102. The court in which such action is brought may assess against such individual a civil penalty in any amount, not to exceed $50,000.

(2) (A) It shall be unlawful for any person to knowingly and willfully

(i) falsify any information that such person is required to report under section 102; and ii) fail to file or report any information that such person is required to report under section 102.

(B) Any person who(i) violates subparagraph (A)(i) shall be fined under title 18, United States Code, imprisoned for not more than 1 year, or both; and (ii) violates subparagraph (A)(ii) shall be fined under title 18, United States Code.

(b) The head of each agency, each Secretary concerned, the Director of the Office of Government Ethics, each congressional ethics committee, or the Judicial Conference, as the case may be, shall refer to the Attorney General the name of any individual which such official or committee has reasonable cause to believe has willfully failed to file a report or has willfully falsified or willfully failed to file information required to be reported. Whenever the Judicial Conference refers a name to the Attorney General under this subsection, the Judicial Conference also shall notify the judicial council of the circuit in which the named individual serves of the referral.

(c) The President, the Vice President, the Secretary concerned, the head of each agency, the Office of Personnel Management, a congressional ethics committee, and the Judicial Conference, may take any appropriate personnel or other action in accordance with applicable law or regulation against any individual failing to file a report or falsifying or failing to report information required to be reported.

5 U.S.C. Appendix 104 says that violators of the Section 102 filing requirements may be sentenced for to up to one year of incarceration and a fine. If there are multiple non-filing or false filings, there might be numerous counts of violation which might result in multiples of the length of incarceration and the fines.

5 U.S.C. Section 104(c) says that the Judicial Conference shall report to the Attorney General anyone not filing or filing false financial disclosures for prosecution under Section 104(2)(B).

Chief Justice Roberts is the head of the Judicial Conference which also includes prominent Courts of Appeal Judges.

As head of the Judicial Conference, Chief Justice Roberts needs to convene the other members and vote to refer Justice Thomas to the Attorney General for prosecution under Section 104(2)(B). The obligation to report the offender to the Attorney General is mandatory using the word “shall refer” to the Attorney General.

It is past time for Chef Justice Roberts to act and convene the Judicial Conference to refer Justice Thomas to the Attorney General for prosecution.

Justice Thomas needs to experience the administration of justice from the recipient end of bringing offenders to justice.