TWITTER, INC. and the ELON MUSK DEBACLE

Pay $44 Billion to Acquire a Company Losing Money and Then Undermine its Revenue Sources, Alienate Advertisers and Users, and Use it to Promote a Right Wing Political Agenda

Along comes Elon Musk, a co-founder of PayPal, buyer of Tesla, Founder of Space X, the Boring Company and others, and he is convinced he is a boy genius and businessman of extraordinary ability. The word is anything he touches turns to gold. So, several people in early 2022 tell him to use his genius skills and acquire Twitter and convert it into something better and profitable. Apparently, Jack Dorsey, Larry Ellison and others put this idea in Musk’s head. So, Musk is fascinated with the idea of being King of Twitter Land and decides to offer $44 billion for the Company at a stock value not as high as Twitter’s highest valuation, but the stock price had been on the decline.

So, let’s take a look at publicly available information that we assume Musk read before offering to buy Twitter and take it private. The best source are the numerous filings made with the Securities and Exchange Commission, the SEC. I’ll focus on the 10-K Annual Report filed on or about February 16, 2022 covering the period through December 31, 2021.

The first chart does a comparison of Twitter to other Internet stocks and shows that Twitter was in ascendancy but for the past couple of years was in a downward trend.

By the end of 2020, Twitter was in an ascendancy path, but starting in 2021 it clearly was on a downward path compared to other Internet Stocks and the S&P 500. So. if you are a gifted corporate visionary you might see this as an opportunity to right the ship and bring Twitter to its prior ascendancy. Musk probably thought he could do it.

The Annual Report then described what it calls the 2021 Highlights:

FY 2021 Highlights

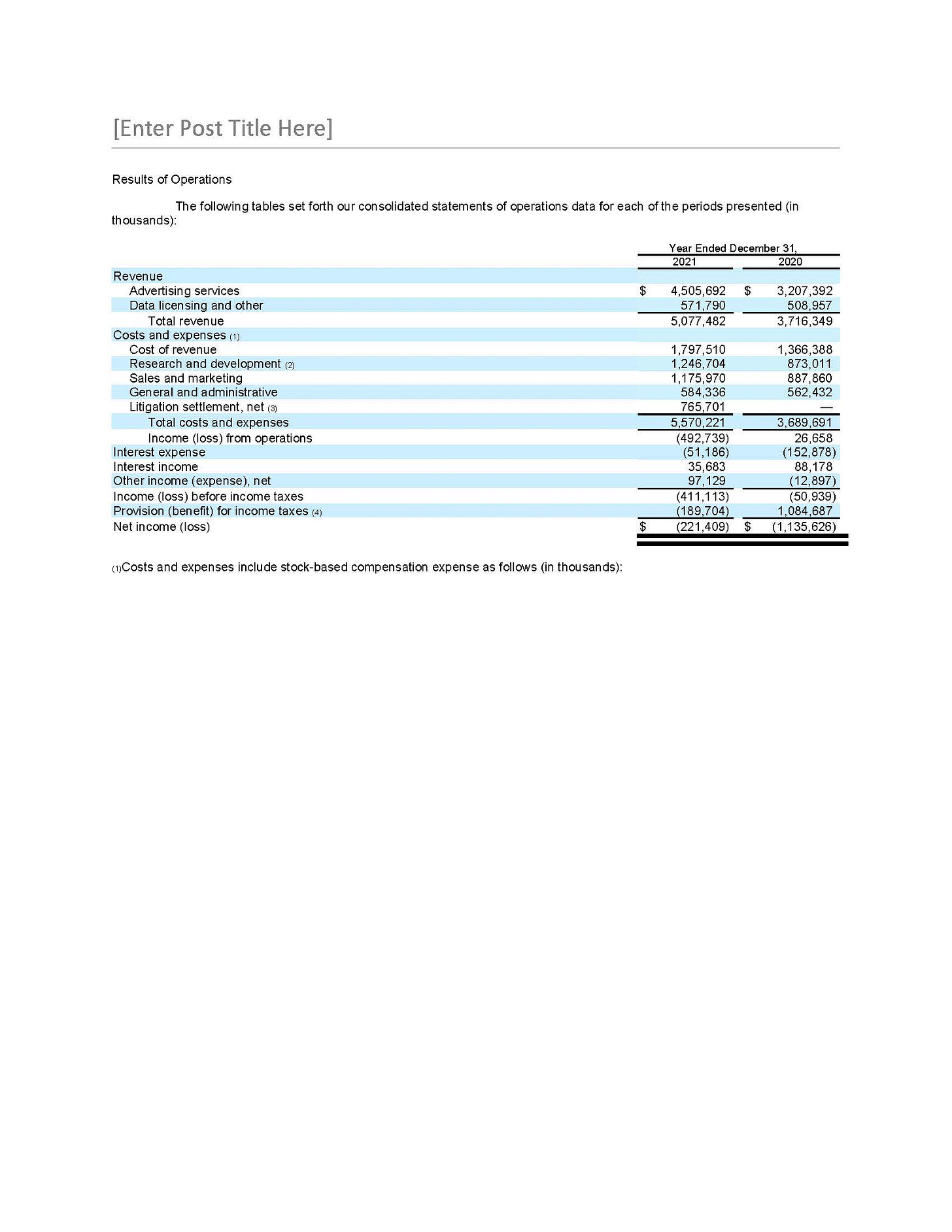

Total revenue was $5.08 billion, an increase of 37%, compared to 2020.

•Advertising revenue totaled $4.51 billion, an increase of 40%, compared to 2020.

•Data licensing and other revenue totaled $571.8 million, an increase of 12%, compared to 2020.

•U.S. revenue totaled $2.84 billion, an increase of 36%, compared to 2020.

•International revenue totaled $2.24 billion, an increase of 37%, compared to 2020.

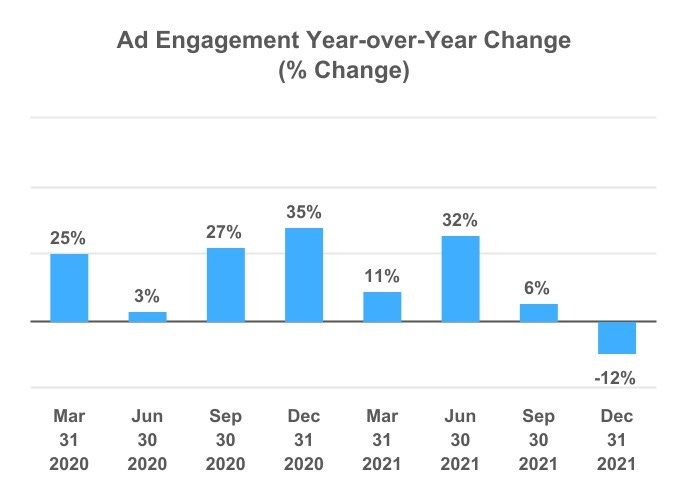

•Total ad engagements increased 7% compared to 2020.

•Cost per engagement increased 32% compared to 2020.

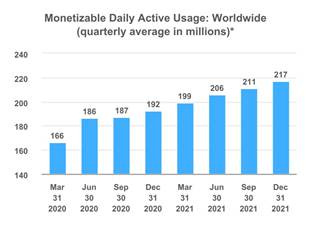

Average monetizable daily active usage (mDAU) was 217 million for the three months ended December 31, 2021, an increase of 13% year over year.

Loss from operations was $492.7 million, or 10% of total revenue, in 2021, compared to income from operations of $26.7 million, or 1% of total revenue, in 2020. Loss from operations in 2021 includes a one-time litigation-related net charge of $765.7 million(1).

Net loss was $221.4 million in 2021, compared to net loss of $1.14 billion in 2020, which was inclusive of a $1.10 billion provision for income taxes related to the establishment of a valuation allowance against deferred tax assets.

Cash, cash equivalents and short-term investments in marketable securities totaled $6.39 billion as of December 31, 2021.

According to this information everything was on an upward trajectory for Twitter. An ideal buy-out opportunity.'

Now how about usage of Twitter:

Again, Usage is increasing worldwide as it is in the U.S. and the rest of the world.

So, even before Musk and partners entered the picture, advertising on Twitter was declining, but 2021 was the year of maximum Covid infections which tended to reduce advertising across the board, so this should not be viewed as a negative for Twitter by comparison to other advertising media.

Now how about the crucial question of revenue, cost of operations and net income:

So, in 2020, Twitter lost ($1,135,626,000). But Operations and Revenue improved by the end of 2021 where the loss was now $221,409,000. Revenue was up significantly in 2021. The interest expense in 2021 was only $51,186,000.

Now let’s look at cash and you can see that cash as of the end of each year has remained about the same in the range of $2,000,000,000. At the end of 2021, Twitter had $2,210,685,000 in cash. One would say not too shabby.

So, looking at all these numbers Musk concluded that this was a good acquisition opportunity. But one had to note that the principal source of revenue was advertising and the rest was rather negligible by comparison.

Now how would you value this company that consistently had losses. The loss in 2020 was ($221,409,000) and the loss in 2020 was ($1,135,626,000). Well however you calculate it doesn’t matter since Musk valued it on acquisition of $44 billion, and he signed a Purchase Agreement with Twitter to buy it at that price.

Musk was now so confident that he could turn Twitter into a profitable world internet forum through his business skills and intellect. He was so confident that he actually did something totally unheard of in major corporate acquisitions, purchase of a family business, buying land, or buying your house or apartment. Musk waived due diligence in the Purchase Agreement.

But then Musk started having second thoughts and started demanding data on what he called bots being unreal accounts not representing real people or organizations. Since he waived due diligence, Twitter was not obligated to give him the data, but they did anyway. Then Musk got cold feet and announced his termination of the deal. But Twitter said not so fast, and filed a lawsuit against Musk in the Delaware Chancery Court to compel performance of the Purchase Agreement. Musk was reportedly told that he had poor odds of winning that litigation, so he turned again and agreed to complete the purchase.

But Musk didn’t want to risk only his own money, so he reached out to equity investors, and based on his reputation for business acumen, he got commitments for equity investment from very wealthy individuals, investment funds and sovereign wealth funds. Among his investors, according to the Washington Post, were:

Prince Alaweed bin Talal al Saud of Saudi Arabia, The Qatar Investment Authority, Binance (another crypto exchange), Andreesen Horowitz, Sequoia Capital, Larry Ellison ("Oracle), Jack Dorsey (co-founder and former CEO of Twitter) and apparently many others having faith in Musk.

Then there are the banks that lent a total of $13 billion for the purchase, including Morgan Stanley, Bank of America and Barclays. In order to get these massive bank loans, Musk had to put up some of his Tesla stock as collateral which could be seized if he defaulted on the acquisition loans. Such loans come with covenants or agreements that certain conditions must occur or certain performance levels must be obtained, but if the covenants are breached, then the lenders can execute on the collateral after declaring a default on the loans.

So, with his equity and debt financing in place, Musk closed on the acquisition, and immediately, on the day of closing, fired the CEO, the General Counsel, the head of their Compliance and Public Integrity divisions. He then fired another 50% of the total 7,500 person workforce, and then after issuing demands that remaining workers had to commit to being “hard core workers,” without really defining what that ambiguous term meant, another 25% of the employees left or were fired. Musk apparently thought that he could run Twitter alone along with people he brought from Tesla and Space X and other loyalists.

Musk has a financing problem. His acquisition bank loans require payment of $1,000,000,000 per year as interest. Apparently, the loans are interest only and not amortizing. But looking at the 2021 total revenue of $5,077482,000 and the Cost of Operations of $5,570,221,000, if everything remained the same, Musk will have a hard time paying the $1 billion of interest unless he comes out of pocket and pays it himself.

But things are not remaining the same. Musk invited former President Trump back to Twitter even though there are multiple major criminal investigations pending and the Trump Organization was just found guilty of criminal tax fraud by a New York jury and now the January 6th Special Committee has referred Trump’s alleged four violations of federal criminal statutes to the Justice Department for prosecution. Trump declined the Musk offer and has remained on his own Truth Social site.

Then Musk decided to be political in the mid-terms and announced that people should vote to put Republicans in control of the Congress. This angered many users, some of whom are leaving Twitter and going to other sites thus decreasing the user numbers that had been increasing until Musk took over.

Musk announced he was a “free speech absolutist” and allowed many who perpetrated hate, white power, racial discrimination, misogyny, antisemitism, and homophobia back on Twitter, welcoming them with open arms. There are various reports from the Anti Defamation League (ADL) and other groups of massive increases of hate speech on Twitter.

But advertisers have not been pleased with these developments as they do not want their corporate ads being exhibited next to hate speech, so many Twitter advertisers announced a “pause” in Twitter advertising, and Civil Rights Organizations asked corporate advertisers to stop Twitter advertising until the hate speech was removed. This has lead to a major loss of the Twitter revenue, and Musk has tried to offset it by charging users $8.00 per month to have a blue check mark by their name stating they are real people and not bots, but this was handled so poorly that many people posted fake accounts claiming they were celebrities or others and as long as they paid their $8 they could claim they were whoever they wanted to be. Musk has announced a new check mark system would be in place by the end of November, but it still seems if you pay Musk your $8 you can claim whoever you want to be. For example, FDR, with a blue checkmark, just followed me.

So things are not looking too good in Twitter land, and Musk has created problems in the other parts of Musk Land: mainly in Tesla, his major source of wealth. Tesla stock has sunk from a high at the beginning of the year of $400 per share to the current $123 per share. This has resulted in Musk losing his richest man in the world standing. Some investors in Tesla feel that Musk has spent too much time on Twitter and has not dealt with issues at Tesla including the close down of the Shanghai Plant during the Covid Zero regime in China. Also, many speculate that Twitter users are not inclined to buy Teslas after Musk started politicking for the Republican Party and even himself tweeting a conspiracy theory that was totally false about Speaker Pelosi’s husband and his attack by a Canadian living in the U.S. Musk’s anti-Pelosi tweet was then retweeted by many on the far-right wing. This has lead to many environmentally conscious people saying they would never buy a Tesla.

Then for an encore this “absolutist of free speech” suspended the accounts of eight or more reporters who had published negative statements about Musk, but after a public outcry, Musk was forced to restore their accounts.

So Musk has acted to decimate advertising revenue at Twitter, alienated Twitter users and advertisers and apparently ignored problems at Tesla.

Then Musk did an on-line poll asking users if he should resign as CEO of Twitter, and 57% said yes. Musk responded saying they would repeat the poll, but only people paying his $8 per month could vote: a poll tax. Others persuaded him to abandon that idea. Now Musk says he will resign from Twitter when he finds someone foolish enough to take the job, and frankly, who would want to have Musk be your immediate boss with his frequent changes of mind and frankly dictatorial behavior.

So, Musk seeing the writing on the wall started going to his equity investors seeking additional equity financing to pay that $1 billion interest charge since apparently with his shrinking Tesla stock valuation, Musk is not inclined to personally fund any Twitter deficit out of pocket.

One would imagine that Musk’s equity investors and bank lenders are not too happy with what has resulted in only two short months. After all, Trump usually took a few years to bankrupt his companies, but Musk already announced a possible Twitter bankruptcy, further making his investors and lenders very uncomfortable.

Musk should resign as CEO immediately, Twitter should rehire staff who were fired, public integrity and monitoring functions should be restored, hate speech and white nationalists should be suspended, and most of all dedicated liars and thieves should be kept off Twitter. Steps need to be taken to make Twitter a safe place for both users and advertisers, and based on performance over two months, Musk is not the person to accomplish those necessary tasks.

Feel free to comment if you have a candidate to be the replacement CEO of Twitter.